- Introduction

- The rise of classic car investments

- Why investing in classic cars is gaining popularity

- Why Invest in Classic Cars?

- The financial benefits of classic car investments

- Factors that make classic cars valuable over time

- Key Considerations Before Investing

- Understanding market trends and potential returns

- Evaluating rarity, condition, and provenance

- The Best Classic Cars for Investment in 2025

- Overview of top classic cars that are predicted to appreciate in value

- Ferrari 250 GTO: The Ultimate Collector’s Car

- Why the Ferrari 250 GTO is one of the most valuable classic cars

- Key reasons behind its soaring market value

- Porsche 911 (1960s-1970s): A Timeless Icon

- The enduring popularity of the Porsche 911 as an investment

- Factors contributing to its appreciation

- Jaguar E-Type: A Beautiful Investment

- Why the Jaguar E-Type remains a solid investment choice

- How to evaluate different models and series

- Chevrolet Corvette (1963-1967): The All-American Investment

- The appeal of the Chevrolet Corvette as a classic car investment

- Notable models that are gaining value

- Mercedes-Benz 300SL Gullwing: A Rare Gem

- The legendary Mercedes-Benz 300SL Gullwing and its investment potential

- What makes it stand out among other classics

- Aston Martin DB5: The Bond Car

- Why the Aston Martin DB5 remains a top choice for investors

- Historical significance and its link to James Bond

- BMW 2002: A Rising Star

- The growing market for the BMW 2002

- How this small luxury car is gaining popularity among collectors

- Maserati Ghibli (1960s-1970s): Italian Performance and Elegance

- The Maserati Ghibli as a unique investment option

- Why the Ghibli is increasingly sought after by collectors

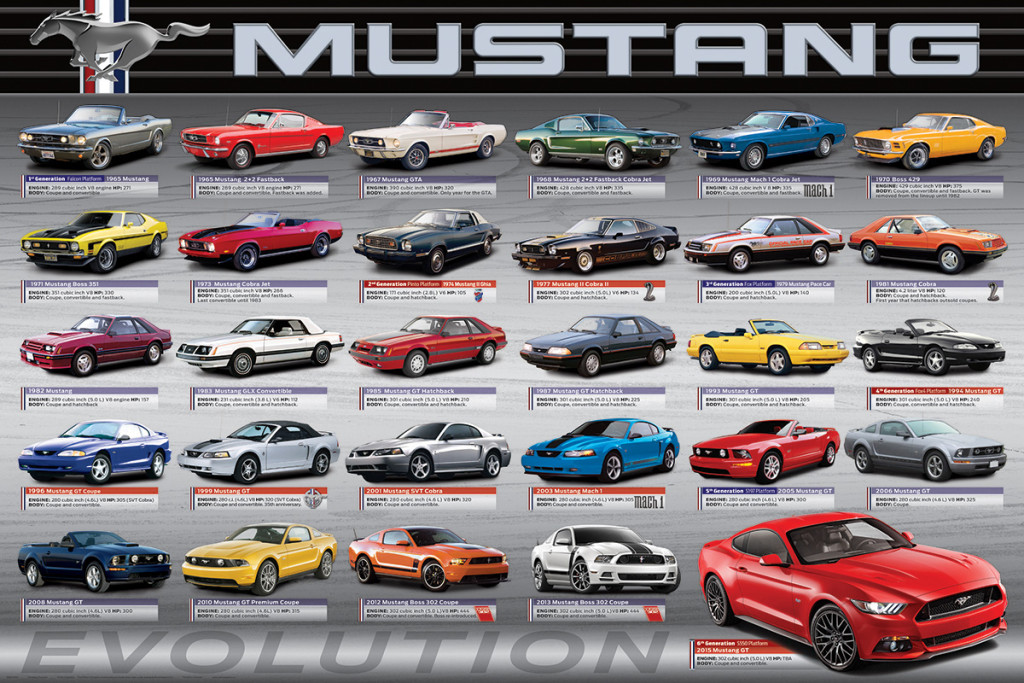

- Ford Mustang (1960s): The American Classic

- Why early Ford Mustangs continue to rise in value

- What makes the Mustang a desirable investment for collectors

- Investing in Classic Cars: Risks and Rewards

- Potential risks when investing in classic cars

- How to mitigate risks and maximize returns

- Where to Buy Classic Cars for Investment

- Best places to find high-quality classic cars

- How to spot good deals and reliable sellers

- Conclusion

- Recap of the best classic cars to invest in today

- Final thoughts on making smart investment choices

- FAQs

- What are the best classic cars for investment in 2025?

- How can I evaluate the value of a classic car before investing?

- Is it a good idea to invest in classic cars for long-term gains?

- Are there risks involved in investing in classic cars?

- How can I find reliable classic car sellers and auctions?

The Best Classic Cars to Invest in Today

Investing in classic cars has become an increasingly popular avenue for collectors and investors looking for something unique, tangible, and, most importantly, valuable. As the automotive world continues to appreciate vintage models, certain classic cars have proven to not only hold but significantly increase in value over time. This article will guide you through some of the best classic cars to invest in today, offering insights into which models are likely to appreciate the most and how to make an informed investment decision.

Why Invest in Classic Cars?

Classic cars are more than just beautiful machines; they’re investments that can offer a significant return. Over the years, the value of many classic cars has skyrocketed, with some models selling for millions at auctions. These cars provide a way for enthusiasts to enjoy their passion for automobiles while potentially making a profitable investment.

Investing in classic cars offers several financial benefits. For one, many classic cars are limited in production, making them rare and highly sought after by collectors. Additionally, the historical significance, brand prestige, and design beauty of certain models can increase demand. The combination of rarity, desirability, and timeless appeal means that classic cars can become much more valuable over time, especially when maintained in pristine condition.

Key Considerations Before Investing

Before diving into classic car investments, it’s essential to understand the factors that contribute to their value. Key considerations include:

- Rarity: Limited production cars tend to be the most valuable. Models produced in small quantities or with unique features are more likely to appreciate over time.

- Condition: Cars that have been well-preserved or restored are always more valuable than those in poor condition. Maintenance and proper storage can significantly increase a car’s market value.

- Provenance: The history of the car, including previous ownership, racing history, and unique features, plays a critical role in determining its investment potential.

The Best Classic Cars for Investment in 2025

While there are countless classic cars worth investing in, some stand out above the rest due to their track record of increasing in value. Here are a few of the best options to consider in 2025:

Ferrari 250 GTO: The Ultimate Collector’s Car

The Ferrari 250 GTO is often regarded as the Holy Grail of classic car investments. With only 36 units ever made between 1962 and 1964, this Ferrari is both rare and incredibly desirable. The 250 GTO has regularly broken records at auctions, with some models fetching prices over $40 million.

Why is it so valuable? The Ferrari 250 GTO combines exceptional performance, impeccable design, and a rich racing history, making it the perfect investment for any car enthusiast looking for an iconic piece of automotive history.

Porsche 911 (1960s-1970s): A Timeless Icon

The Porsche 911 is arguably one of the most beloved sports cars of all time. Early models from the 1960s and 1970s, such as the 911 T, 911 S, and 911 Carrera RS 2.7, have become increasingly sought after by collectors. As Porsche enthusiasts continue to celebrate the 911’s legacy, demand for these early models has increased, making them a reliable investment.

The Porsche 911’s timeless design and legendary performance, coupled with Porsche’s continued reputation for quality, have cemented its place as one of the best classic cars to invest in.

Jaguar E-Type: A Beautiful Investment

The Jaguar E-Type is one of the most iconic British sports cars of the 1960s. Known for its stunning design and impressive performance, the E-Type has remained a collector’s favorite for decades. Models from the early years, especially the Series 1, continue to see strong appreciation in value.

Investors should look for well-maintained examples, preferably those with matching numbers and original components, as these factors can significantly increase a car’s value.

Chevrolet Corvette (1963-1967): The All-American Investment

The Chevrolet Corvette, particularly models from the 1963-1967 era (known as the “Mako Shark” period), has become one of the most desirable American classic cars. The mid-year “Sting Ray” models are especially sought after, thanks to their iconic styling and exceptional performance.

Chevrolet’s Corvette has a devoted fan base, and demand for these early models continues to rise. As an investment, the Corvette offers the potential for significant appreciation while maintaining a strong cultural significance.

Mercedes-Benz 300SL Gullwing: A Rare Gem

The Mercedes-Benz 300SL Gullwing is often regarded as one of the most beautiful and technically advanced cars of its era. With its distinctive gullwing doors and innovative engineering, this car is a true masterpiece of automotive design.

The 300SL’s rarity, combined with its strong historical importance and high-performance pedigree, makes it a top choice for classic car investors. Models in excellent condition continue to fetch multi-million-dollar prices at auction.

Aston Martin DB5: The Bond Car

The Aston Martin DB5 is famously associated with James Bond and is often regarded as the ultimate British luxury sports car. Its connection to the 007 franchise has only increased its appeal among collectors.

The DB5’s performance, timeless beauty, and cultural significance make it an excellent investment. As Bond’s car of choice, the DB5 holds a unique place in both automotive history and pop culture.

BMW 2002: A Rising Star

The BMW 2002 is a rising star in the classic car market. With its combination of sportiness and practicality, the 2002 was a favorite of driving enthusiasts in the 1960s and 1970s. As more collectors discover its potential, the market for the 2002 has begun to rise steadily.

Look for models in excellent condition or those with unique features, such as the 2002 Turbo, which is particularly rare and desirable.

Maserati Ghibli (1960s-1970s): Italian Performance and Elegance

The Maserati Ghibli, with its striking design and performance credentials, is a great investment option for collectors looking for something a little more unique. Produced in limited numbers, especially the 1960s-1970s models, the Ghibli continues to grow in popularity among collectors.

The car’s blend of Italian craftsmanship, luxury, and power make it a standout investment choice.

Ford Mustang (1960s): The American Classic

The Ford Mustang, particularly early models from the 1960s, is one of the most iconic American classic cars. With its aggressive styling and V8 power, the Mustang became a symbol of freedom and American muscle.

Investors should focus on rare models, such as the Shelby GT350 or GT500, which are known to appreciate significantly in value over time.

Investing in Classic Cars: Risks and Rewards

While investing in classic cars can be profitable, it’s important to acknowledge the risks involved. The value of classic cars can fluctuate based on market trends, and not all cars will see the same level of appreciation. It’s important to do thorough research, seek expert advice, and invest in cars that have a strong historical significance and are well-maintained.

Where to Buy Classic Cars for Investment

Finding the right car to invest in can be challenging, but there are several reputable places to start. Classic car auctions, dealerships specializing in vintage vehicles, and private sellers can be great sources for finding high-quality cars.

Look for cars that are in excellent condition, have documented provenance, and come with a clear maintenance history. The more details you know about a car, the better equipped you will be to make an informed investment.

Conclusion

Investing in classic cars is a unique way to diversify your portfolio while enjoying the thrill of owning automotive history. The best classic cars to invest in today combine rarity, beauty, and performance, making them valuable assets that continue to appreciate over time. Whether you choose a Ferrari 250 GTO, a Jaguar E-Type, or a Ford Mustang, investing in classic cars is an exciting way to combine passion with financial reward.

FAQs

What are the best classic cars for investment in 2025?

Some of the best classic cars to invest in include the Ferrari 250 GTO, Porsche 911 (1960s-1970s), Jaguar E-Type, and Mercedes-Benz 300SL Gullwing.

How can I evaluate the value of a classic car before investing?

Factors to consider include rarity, condition, provenance, and market trends. Look for well-maintained cars with documentation and strong historical significance.

Is it a good idea to invest in classic cars for long-term gains?

Yes, classic cars can be a great long-term investment, especially those that are rare, well-preserved, and historically significant.

Are there risks involved in investing in classic cars?

Yes, there are risks, including market fluctuations and the potential for high maintenance costs. It’s important to research and choose wisely.

How can I find reliable classic car sellers and auctions?

Look for established classic car auction houses, reputable dealerships, and private sellers with a solid track record of selling quality vehicles.